Compound interest plays a huge role in wealth-building and passive income. If you take whatever money you have left over each month after paying your ongoing bills and invest it, you can take advantage of compound interest.

Over time, your money grows with little to no work from you. It’s in this sense that compound interest acts as an agent—or catalyst—of additional passive income.

What’s great about setting up passive income and using compound interest is what it does for your life: You can work less, retire earlier (if you wish), have fewer money worries and, more importantly, have more time to enjoy life.

Anyone can use these tools–but, unfortunately, so few do. The wealthy understand compound interest and use modes of passive income; the poor do not. It’s like a big secret that most people never learn.

By reading this article, you will become one of the few who truly understands and takes advantage of compound interest, which is a huge component of growing your net worth.

Compound Interest in Action

In order to take advantage of it, you must first understand the basics: In the simplest terms, compound interest is earning interest on interest.

For example, let’s say you’ve saved $1,000 and deposited it into an investment account. For simplicity reasons, we’ll say you’re going to earn 10% each year on that money and that you don’t add any more money to that account after your initial 1K deposit. You would earn $100 on interest on that 1K after a year ($1,000 x .10=$100). That would leave you with $1,100 after that first year.

Year two you would earn 10% interest on $1,100—not just 1K—because that’s what you now have. So at the end of the second year, you would earn $110 interest, not just $100, because you started year two with $1,100 (your $1,000 initial investment plus the $100 in interest). So you earned $10 more in interest than the previous year. You now have $1,210.

You would then start earning 10% interest on $1,210 for year three and have $1,331 at the end of the year.

If you continue to earn the annual rate of 10% for 10 years, you would have $2,593.74 at the conclusion of the decade.

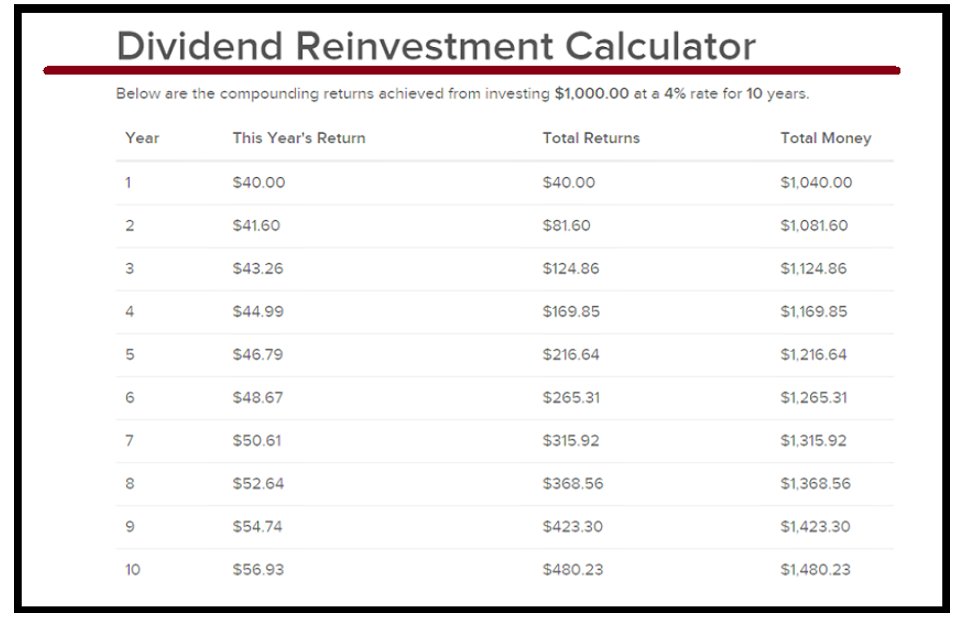

Even if you earned a modest 4% interest a year, you would still end up with $1,480.32:

Compare this to putting the $1,000 in an account that doesn’t earn any interest. After ten years, you would still just have 1K—and your money would actually be worth less due to inflation.

Now imagine this on a much grander scale: What if you were to save $5,000 a year and add $5,000 each for 20 years. Let’s say you earn 8% per year, which is a reasonable rate to earn in the stock market.

At the end of those 20 years, you would have roughly $270,000. Compare this to if you didn’t earn any interest, which would be a total of $100,000. By putting your money into an investment vehicle that returns a strong rate, you’ve “earned” yourself an additional $170,000 without doing any additional work.

Like a Fine Wine, Compound Interest Takes Time

When you start investing has a huge impact on how much money you’ll have in your later years. If you start early enough and invest regularly, you could easily reach millions of dollars by the time you reach your golden years. Conversely, the later you start, the harder it is to attain extraordinary wealth.

Let’s say you decide to invest $250 a month in an account that averages an 8% annual return. In one scenario, you start doing this at age 25. In another, it’s age 35 and in a third scenario, age 45. Even though you invested the same amount each month, by age 65, there is a vast difference in the amount of money you would have:

From age 25= $878,570

From age 35=$375,073

From age 45=$148,236

No matter what your age, the time to start is today if you haven’t already. The other point is that you must be consistent in depositing a set amount each month or quarter. Figure out what you can afford to invest and then do it without fail.

The Real Value of Passive Income and Compound Interest

Warren Buffet has called compound interest the eighth wonder of the world. The true magic of it is how it can give us the gift of more time to enjoy life while still increasing our wealth. People who struggle financially all of their lives may work hard for their money but don’t set up their lives to make their money work hard for them.

Setting up your life with initial forms of passive income and then investing some of that income into accounts that bear interest rates higher than inflation becomes like a money snowball rolling downhill: It grows larger and larger with little to no effort from you.

Understanding and utilizing how passive income and compound interest is one of the easiest ways to increase your net worth—and it’s one of the primary ways the wealthy get wealthier. You can use it, too, to change your financial future.

How You Can Get Started In Investing

If you’re not already investing, what’s holding you back? And when it comes to investing, are you getting the best returns?

Personally, I believe that investing in solid companies that pay a dividend above the rate of inflation is the way to go. This is a great way to take advantage of passive income and compound interest with little risk.

Here’s what you can do to take advantage of passive income and compound interest:

Step 1:

Set up a brokerage account with a company like Fidelity, Charles Schwaub, Vanguard or the app Robinhood if you haven’t already.

Step 2:

Start saving at least 10% of your NET income if you aren’t already. Have this money go directly into your brokerage account so you can’t spend it. Do this immediately! The faster you get started, the more you can take advantage of compound interest.

Step 3:

Go over any investments you may have with a fine-toothed comb. Compare them to top-performing mutual funds and solid companies that pay a dividend between 3.4% and 7%. (To compare funds or stocks, visit your brokerage’s website and type your mutual fund or stock ticker symbol into the search bar.)

Look for any stocks or funds that aren’t giving you the best rate of return. Small percentages can add up to big differences in wealth in the long run.

For example, if you have a mutual fund that is returning 5.4% on average but there is another mutual fund that has a history of returning 6.2%, then you should consider moving your money.

That .8% may not feel like much of a difference but it will add up to a large difference over the course of many years, especially as you add more and more money to the fund.

Step 4:

Go over other money-making vehicles in your life, such as savings accounts, CD’s, cash-back credit cards, bonds etc. Look for the highest-yielding accounts in these areas.

Remember, a few percentage differences here and there can really add up over time. If you take advantage of even the smallest of differences in each avenue of your investing avenues, you’ll create a big snowball effect on our net worth in the long run.