There are many differences between the habits and decisions of the affluent and the middle class and poor, and how each uses a credit card is one of the differences.

Middle class and poor people use credit cards as a temporary loan to pay for things. Sometimes these things are essential and sometimes they’re not, but there is often a balance that carries over to the next month. In other words, it’s a tool that is used to create debt.

The affluent, however, use credit cards to earn a percentage back on any purchases they make and pay off the balance each month. It’s in this sense that their credit cards become a tool to contribute to their overall wealth.

Of course, I understand that it is easier to pay off a card each month when you are already wealthy. But what I’ve learned by working with all kinds of families over a twenty-year period is that most Americans have too much stuff. That “stuff” leads to less money in our pockets and can also lead to a hefty credit card bill. If you want to increase your net worth, it’s imperative that you get your spending under control.

All this stuff we buy has a huge impact on our net worth over the long term. Middle class and poor people say to themselves, “It’s only X dollars for this item so what’s the big deal?” The big deal is that all those little (and not so little) purchases add up and when you don’t have much money left to invest, you can’t take advantage of compound interest, which is hugely important when building wealth.

On the other hand, if you can pay off your debt and just use a cash-back credit card as a tool of convenience to pay bills and even that vacation you can truly afford, then the money you earn back on your purchases becomes a form of passive income.

It may not be a huge amount but the path to true wealth is to have as many avenues of passive income as possible and even relatively small amounts can help.

Getting Rid of the Negative

The first step for using your credit card as a positive instead of a negative is to pay off any outstanding balances you have first. This may require some extreme steps, like selling off your house (yes, really), trading in your vehicle for one that is less expensive, selling off some of your belongings and cutting way back on spending.

No one ever likes to hear this but if you want your net worth to go up instead of down and you owe a lot on your cards, then extreme measures are necessary. Your goal is to get your debt down to an amount that is small enough that you can pay off the total each month.

Once you have your cards paid off—other than a manageable amount that you can pay off when it’s due each month—then you can begin the process of turning your card into a tool that starts making you money instead of depleting it.

One thing that anyone who has amassed credit card debt has to be very careful of once the debt has been paid off is to not get back into the spending cycle. If you’ve had a history of credit card debt, then you should pay off your cards and then stick to paying cash for anything but auto-pay for bills (more on that later) until you can change your mindset about money and get your spending under control.

It can be easy for us to run up our credit cards after paying them off because studies have shown that using a card instead of cash makes it easier to overspend because it’s a piece of plastic instead of the actual dollar bills that we’re using.

It also doesn’t help that credit card companies like to give generous limits because it means more money for them—the more we spend, the more money they make in fees from the merchant, and late fees and interest from the us (when applicable). On top of all of that, there’s no immediate penalty for spending more than what’s in our checking accounts.

To get a better handle on credit card spending now and in the future, one trick I can share with you is to visualize how much cash that would look like when you’re considering buying an item—especially if it’s a non-essential. Want to book that cruise that’s going to cost thousands? Visualize handing over that amount of cash to an actual person who could book that for you, like a travel agent (even if it’s a faceless company you’re using).

From Negative to Positive

Once you have your spending under control and have managed to pay off any balances that are beyond what you can afford to pay off each month, you will want to look at your current credit card with scrutiny. Some key points you want to find out about the card are:

-Does your current card offer cashback or is it some other type of reward?

-If it’s cashback, what percentage are they offering?

-Is this percentage on all purchases or just certain purchases?

-Do you get the cashback directly or do you have to buy gift cards with it?

What you’re looking for is a card that gives you cash back—not airline miles, not gift cards, but cold hard cash that you can apply straight to the balance of your card or have deposited into your bank account. Why? Because cash is king. You can’t pay a medical or electric bill with airline miles or gift cards. But money in your bank account or a reduction on your current credit card statement? That works every time.

When it comes to the cash back, you want one that pays you at least 1.5% on all purchases. Forget the cards that give you a higher percentage but only on select purchases. You’re going to be setting up your bills to be charged to your account (more on this later) and cards that only offer discounts on select purchases never include ongoing expenses such as utility bills.

There are some that even change which purchases get the discount every few months or so. This is confusing and they do it on purpose so that it’s harder for you to take advantage of. For example, I recently came across an ad for a card that gives 3% back on certain purchases, like gas, for three months. After the three months is up, it changes to another category. Who has the time and energy to keep up with that? It’s like a game of Whac-a-Mole. And if you’re not a big spender in the “category of the moment,” then you really lose out.

With competition for customers being fierce, many credit card companies have upped the ante with some stellar returns. I’ve put together a list of cards currently offering a 1.5% return or higher (but keep in mind the choices and terms of credit cards are constantly changing so be sure to always read the fine print carefully!)

These cards are:

-Capital One Quicksilver Cash Rewards Credit Card (1.5% unlimited cash back on all purchases)

-Wells Fargo Cash Wise Visa Card (1.5% unlimited cash back on all purchases)

-Chase Freedom Unlimited (1.5% unlimited cash back on all purchases)

-Fidelity Rewards Visa Signature Credit Card (2% unlimited into an eligible Fidelity account)

-HSBC Cash Rewards Mastercard Credit Card (1.5% unlimited cash back on all purchases)

-American Express Cash Magnet Card (1.5% unlimited cash back on all purchases)

Some of these cards will give you a sign-up bonus, such as double the cash back for the first year or a bonus when you spend a certain amount. (Be careful with the bonuses, though. You don’t want to be encouraged to spend unnecessarily!)

You should also look at the APR (annual percentage rate) they’re charging for any balances that you might carry over in the future. Although this should matter a lot less now that you are going to set up your lifestyle to pay off your balance each month, it may matter in the future should there be an emergency. You always have the option to have two cards—one for monthly expenses and one with a lower APR should you need to pay off a balance over several months or more—if your cashback card has a higher annual rate.

Set Up Your Passive Income System

Passive income is when you get money with little to no further work once you’ve set up the system for it. You will now be using your credit card as a tool to create passive income.

If you’re going to pay a bill, you might as well get some money back. If you don’t have it set up already, you will want to put any regular bills on auto-pay with your credit card. For whatever reason, some utility companies are stuck in 1985 and still won’t let you set up auto-pay using a credit card—you have to use a bank account.

But for all the ones that do, set this up right away. I have my electric, all insurance plans, Amazon Prime and cell phone bill all connected to my credit card. (Unfortunately, all my other bills must be paid via checking account.) Put as many of your recurring bills on here as possible.

All of this extra money adds up. And the great thing about it is that it’s free. It’s just like as if someone is handing you a check for doing nothing. And if you take the money you get back and invest it over your working lifetime, you can grow it into something decent.

To demonstrate, let’s do a hypothetical situation and see how much you can have at the end of 20 or 30 years. Let’s say you set up some of your bills to be charged automatically to your cash back card and also used it for some miscellaneous expenses each month. I’ve used estimated amounts based on average statistics for electricity ($1320 per year) and car insurance ($1440 per year) plus I added a miscellaneous recurring bill ($1,200 per year) , along with some additional spending per month for items such as gasoline, groceries, clothing etc at $6,000 per year).

All of this adds up to $9,960 per year. We’re going to go with the 1.5% cash back rate, which would give you roughly $150 per year in cash back. This may not sound like a lot but wait! There’s more…

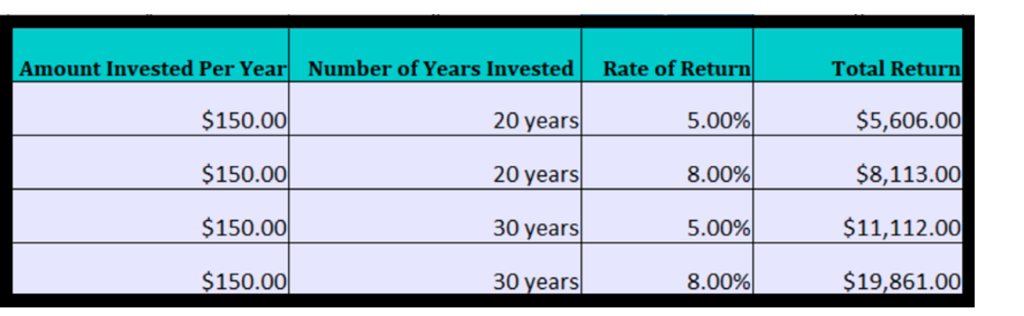

If you take that $150 and invest it each year for 20 or 30 years, you could end up with a decent chunk of change, depending on the length of time and your rate of return. You could end up with anywhere between 5K and 20K (before inflation and taxes) using compound interest:

While none of these sums will make you rich, it proves that credit cards—when used correctly—can be a mechanism that can be used to increase your wealth instead of decreasing it.

Don’t Spend Just to Get the Cash Back

You have to be disciplined here. If you have a history of running up your credit card then you would be better off just cutting them up and paying by cash until you can truly get your spending under control and know the reasons why you overspent in the first place.

Never use the fact that you get cash back as an excuse to buy something. It’s a small percentage and won’t even cover the taxes on the item. Stick with buying items you would have bought anyway as if you’re not getting anything back and the cash back will be a nice bonus.

If you remember this rule, along with the others I’ve outlined here, you’ll be well on your way to increasing your net worth. Obviously, this method isn’t going to have a massive impact on your overall net worth but the idea is that it’s part of an overall plan that will increase your odds of being wealthy in the long run:)